Modern Financial Industry

Traditional financial institutions, private equity investment, wealth management, fund management, transaction in assets, asset management, trade financing, consumer finance, financial technology, supply chain finance, finance lease, finance assurance, bills discounted, credit rating, investment consultation and finance-related- technology, education, research and development, training, trading platform. Plus, the enterprises that providing technical and informative service for the above fields.

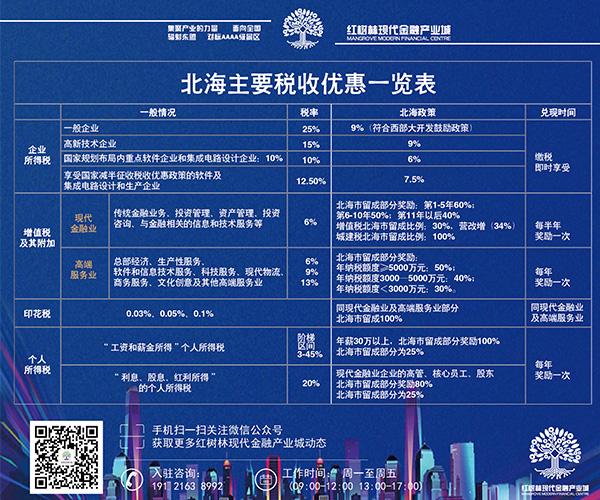

INCENTIVES FOR MODERN FINANCIAL SERVICE INDUSTRIES

◆Preferential Tax

The acknowledged enterprises that supported by 'The Great Western Development Strategy' could reduce the corporate income tax at a reduced rate of 15% and be exempted from the corporate income tax belonging to local sharing, namely corporate income tax rate being 9%

◆Tax Incentives

For the newly registered or established enterprises of modern financial service industries in Beihai, continuous financial support would be provided since the opening day. The limit of supporting fund in the current year is calculated by a certain ratio according to the retained portion of the local government finance of its actual

tax payment in the previous year:

1st to 5th year: 60%, 6th-10th year 50%, from 11th year: 40%

◆Support for the Financial License

1.Provide specialized supporting service for pre-approval access of local financial enterprises of small loan, commercial factoring, finance lease, finance assurance, pawn, etc.

2.For the single private equity fund that newly registered or established in Beihai, with accumulative more-than-50-million-yuan and continuous over-one-year investment in Beihai, one year after the investment the calculation ratio of supporting funds for the remaining years would be increased by 5%.

3. The financial enterprises registered in Beihai are encouraged and supported to expand the market both home and abroad, with the key area in southwest China and ASEAN. The application for relevant permission and license should be strongly supported.

INCENTIVES FOR HIGH-END SERVICE INDUSTRIES

High-end service industries, Headquarters Economy, Productive Services, Software and Information Technology Services, Scientific and Technological Services, Modern Logistics Business Services, Cultural Creativity and Other High-end Services identified by the Leading Group of Beihai High-end Services.

◆Tax Incentives

For the newly registered enterprises of high-end service industries in Beihai, If the main business income accounts for more than 50% of the total income, continuous financial support would be provided since the opening day. The limit of supporting fund in the current year is calculated by a certain ratio according to the retained portion of the local government finance of its actual tax payment in the previous year:

Yearly actual tax payment 30 million: 30%

Yearly actual tax payment 30-50 million: 40%

Yearly actual tax payment2 50million: 50%

Note: Yearly actual tax payment refers to the actual yearly tax paid by the enterprise (including the individual income tax from the equity transfer of the enterprise's shareholders and senior executives, the dividend income and the individual income tax paid by the partnership's operation, excluding the individual income tax from wages and salaries)

One Discussion over Each Matter

For the leading enterprises, the 'unicorn' enterprises, and the financial enterprises that fill the industrial blank in Guangxi or Beihai, the policy of financial support could be approved by 'One Discussion over Each Matter'.